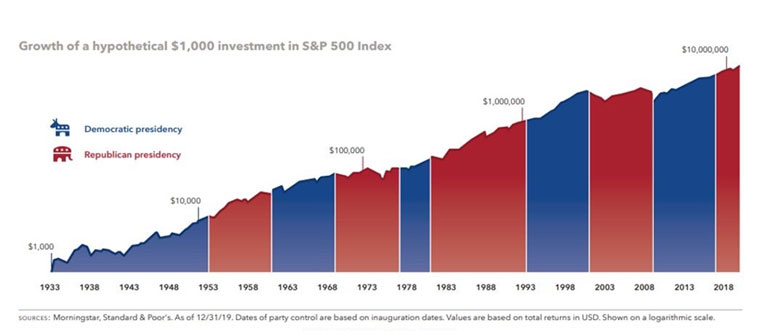

"Battle Royale"

Politics. We hate to talk about it. Even the best of friends or spouses can disagree vehemently over political ideology; especially during this campaign season, which seems to have taken divisive rhetoric to a new level. However, not addressing the 800 pound gorilla in the room can be just as bad for your finances as...