It seems the only appropriate way to address the current situation is to cancel our 8th annual Investor's Final Four. Readers have become accustomed to our 1st quarter synopsis that addresses the biggest investable themes and how they might play out for the remainder of the year. But this year, I think we can all agree there is a clear tournament "Winner," and we don't really need to seed the competitors or playout the matchups. The Coronavirus (COVID-19) has taken over every aspect of our lives. It's the source of 24/7 media bombardment, health concerns, financial fear, and panic over economic collapse. At this time last year, we wrote that "investors have had a perfect bracket through the end of the first quarter," and it was true, US Stocks were up 13.65%, on their way to 30% gains for 2019. Now, it seems almost unimaginably the opposite, with the S&P 500 at one point down greater than 35% from the highs reached just weeks ago in February. How did we get here so fast, where do we go from here, and what's an investor to do in this crazy environment?

What started off as a decent follow up gain from last year quickly deteriorated. U.S markets were up close to 5% midway through February on the back of a robust economy with low unemployment, reduced tensions over a trade war with China, and a rate-neutral Federal Reserve (Fed) likely to stay apolitical in an election year. All of that changed quickly and has spiraled downward faster that almost any previous market fall in recent history. Parallels with the 9/11 terrorist attacks and the 2008 financial crisis at first seemed overstated, but now the short-term pain rivals those infamous events and has wreaked havoc on almost all asset classes. The beginning of the correction was mostly confined to stocks of certain industries that were likely to be most affected, such as the airlines, restaurants, and hospitality. Then like the virus, it broke containment and spread to the whole of the economy as the federal and many state and local governments took measures to intentionally shut-down significant portions of the economy. Through it all, the Fed eased monetary policy early and often, but hasn't been able to recreate the successful market response it got during the Financial Crisis of 2008. Investors have just shrugged off the increased measures. Of course, at its core this is a health crisis, and not a financial crisis, so many of the tools available to the Fed won't help ease the fear that is so pervasive at this time. They do, however, serve the very important function of keeping liquidity ever-present and preventing an even further panic from infecting other relatively sound and functioning parts of our capital markets. Optimistically, the Fed has greased the wheels significantly. Whenever we do reach that inflection point in the fight against the disease, the economy can get back up and running as smoothly as possible.

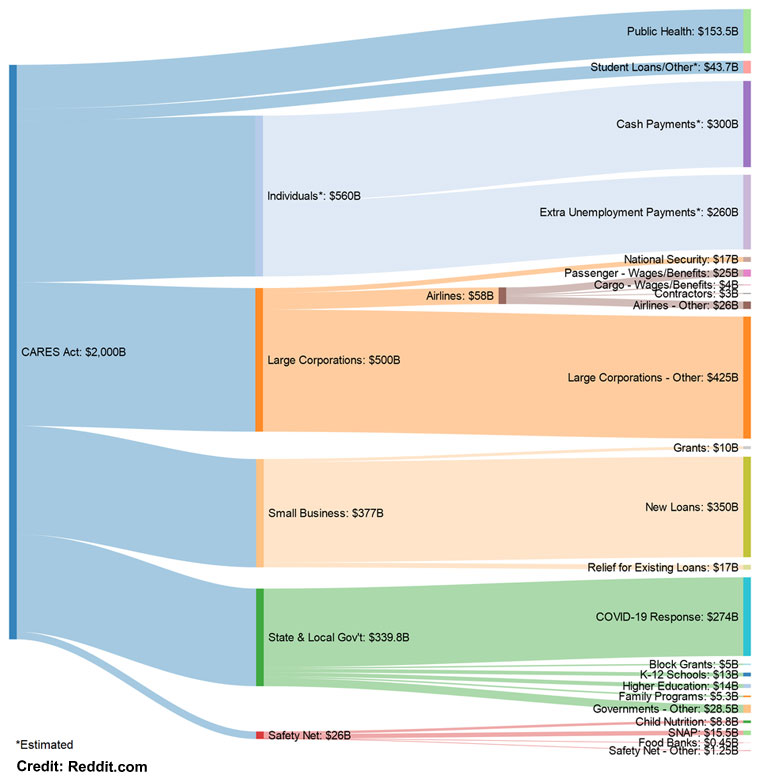

On the fiscal front, the government has undertaken several measures to try and ease some of the burden faced by many Americans. On March 27th, Congress passed and the President signed into law its 3rd coronavirus related bill, The CARES Act. This $2 Trillion stimulus package aims to help many beleaguered aspects of the economy for individuals, small businesses, big corporations, and state and local governments, whose budgets are also stressed and stretched very thin as they enforce social distancing and shelter-in-place orders in some locations. The CARES act seemed to be well received by the market at large, and induced a massive 20% rally off the lows of the year in just 3 days. This is a historical move to the upside not seen since the 1930s as the country and markets worked out of a deep depression. While the CARES act does a lot to aid the economy in the short to medium-term, it will not cure the virus or increase treatment options. A healthy dose of skepticism over the recent bullish sentiment should keep investors at bay until the cases peak. In the meantime, some of the provisions in the CARES Act should provide relief to distressed citizens.

In approximately 2-3 weeks, individuals making less than $75,000 or couples making less than $150,000 on their most recently filed tax return will receive a one-time payment of $1,200 per adult and $500 per child (does not apply to college-age children 19-24). This credit phases out proportionally and is eliminated for incomes over $99,000 and $198,000 respectively, and it will be electronically deposited if the IRS has your banking information on file. All others can await your check in the proverbial mail.

The bill also expands access and payments for those who must now file for unemployment. The base unemployment insurance is covered at the state level, so your underlying benefit and term may vary, but the government is expanding the insurance to add $600 per week to that amount. This boosted payment will be good for four months. Additionally, the bill extends the amount of unemployment pay allowable by 13 weeks.

Some other interesting and helpful provisions of the bill include being able to access your retirement funds in your 401(k)s via "hardship" withdrawals. The typical 10% penalty for early withdrawal before age 59 1/2 is waived, and you can access up to $100,000. Ordinary income tax will still be owed on these distributions, but you have the option of spreading the income out over the next three tax years or even re-paying the withdrawn amount back into the account over that time frame to avoid taxation. Investors should consider this option as more of a last resort, as tapping your retirement funds and selling investments in an adverse market is not typically the best practice for increasing long-term results. On that note, The CARES Act allows investors that don't need additional funds to support their retirement lifestyle to skip Required Minimum Distributions (RMDs) in 2020. Another possible strategy to take advantage of the down market would be to do a partial or total Roth IRA conversion. The amount you convert is taxed as ordinary income, but all future investment growth would then be tax-free indefinitely and not subject to future RMD requirements. Finally, don't forget to rebalance your asset allocation back to your long-term targets. Many portfolios may be slightly imbalanced due to the precipitous sell-off. Getting back to your appropriate risk/reward diversification will smooth out future returns.

We will get through this together. Maybe in a perverse way it will heal many of the divisions that have so harshly separated us from each other politically, socially, and even economically. The country will bounce back. The markets around the world will survive this. We will all be more inter-connected than ever before, fighting for a common goal to bring back the way of life we know and love. All we need is a little time, and I'm confident that the collective genius among our population will solve this crisis, and that investors will be rewarded for their patience and wherewithal to stick with their long-term plan. Remember to keep calm and wash your hands. You may save lives and your portfolio. In the meantime, please thank your local healthcare professionals and all those on the front-line courageously fighting this disease.