As the champagne corks popped this New Years Day, it not only marked the end of 2019, but also the end of a decade. The S&P 500 cumulatively returned 185% over the last 10 years, and that's before accounting for dividends. The cherry on top of this investment sundae was the 33% total return we just experienced in 2019. As we sit in front of a stock market that looks delicious, will we get to continue enjoying our dessert, or are we going to watch our sundae melt?

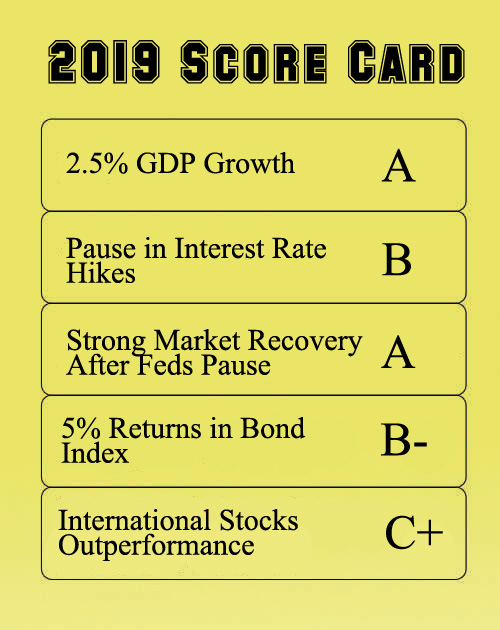

Before we dig into our 2020 outlook, lets first see how our prior year predictions panned out. We started 2019 following a mild bear market slump in the 4th quarter of 2018 which caused the S&P 500 to lose 20% on the back of aggressive Federal Reserve interest rate hikes. Our primary thesis for 2019 was that the Fed had gone too far, and they would announce a pause in hikes that would stave off recessionary fears and lead to a strong market year for asset classes across the board (despite pundits pricing in two additional hikes in 2019).

Our prediction for the year was spot on, and stocks around the globe had a stellar year with bond holders even making close to double digit returns. While we expected Jerome Powell and the Fed to just pause rates, he decided to go all in on the monetary sprinkles and cut rates an appetizing three times. Consequently, this was the primary driver of out-sized asset returns this past year and the past decade for that matter.

Our expectations are for 2020 to be a rocky road—a bit chunky and full of bumps, but still delicious. Domestic stocks have annualized 13.5% for the past decade versus the historical average of 10.2% since the 1920s. As a result, price to earnings (P/E) multiples are a bit expensive currently with much of this return driven by the five large-cap tech giants who have an average P/E ratio of around 40, compared to the broad market average of around 18. This discrepancy means growth stocks are priced for perfection going forward. So, with big tech still in the congressional crosshairs and rich valuations, we feel it is time for the growth stocks to take a bit of a pause as the flavor of the month. Plain vanilla value-oriented stocks have been out of favor for years, but seem to be making a bit of a comeback, and we think that continues in 2020.

After a strong market year like we saw in 2019, historically momentum follows into the New Year. In fact, when the stock market has gains of 25% or more in a year, the following year is also positive two thirds of the time, with an average annual return into double digits. The most recent example of this was 2013-14, when the S&P 500 followed up a 32.4% return with 13.7% the next year. The stock market is a forward looking animal, so the strong results of the past year are signaling a healthy economy for the next several quarters. With continued low unemployment, low interest rates, strong consumer spending, and a fairly optimistic business climate we are forecasting another year of 2.5% GDP growth in the US. We also expect this to equate into a sweet market return of around 10% for domestic stocks. While we still expect positive results for the bond market as well, the prospect of an election year and a diminishing fear of recession will likely keep the Fed on the sidelines for the whole of 2020. In an attempt to appear apolitical, we expect that unchanged interest rates will keep bond returns contained at under 3%.

While we are expecting positive year-end results, we are not expecting a straight line to get there. It's the start of election season here in the US, and that alone will be a reason for investors to be a little more risk averse with their investments. Much of this uncertainty is driven by just how wide open the Democratic field is. There are currently half a dozen candidates who could walk away with the nomination. Come November, regardless of which candidate prevails, the general election conclusion should provide clarity over the direction of domestic and international policy and lift markets near the year-end.

Our final prediction is that we expect geopolitical tension to increase. While it's possible that a phase-one deal with China may be signed as early as January 15th, President Trump has shown an affinity for tariffs and will likely expand this strategy further to involve other countries besides China this year. Couple that with the rise in Middle East tensions, a potential hard Brexit, and the ensuing volatility will likely be the cause of multiple 5%+ market dips in 2020. In this environment, commodities and safe haven assets such as precious metals may periodically outperform. If you need cash in the near-term, it might be wise to eat your dessert first because some profits might melt if you wait too long.