This year it seems like “March Madness” isn’t solely reserved for the basketball court. After a strong January, and a largely positive start to the investment year for most asset classes, the last month of the quarter has brought some serious headlines and volatility back into the market. As we digest the news and consider its ramifications, let’s look at the four top investment forces so far this year and anticipate which will have the most impact on your portfolio.

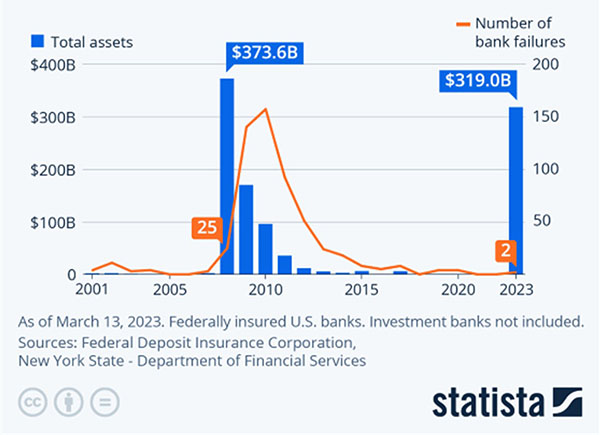

Why don’t we start with the elephant in the room…out of the West, we have a team that thankfully has missed the tournament since way back in 2008. The Federal Deposit Insurance Corporation (FDIC), established in 1933, is a government entity created to regulate banks and step in to insure depositors in the case of insolvency. Earlier this month, the FDIC had to step in and take over Silicon Valley Bank (SVB) and Signature Bank, the 2nd and 3rd largest failures in US history. Now, this is not to say we haven’t had banks fail since 2008, in fact, since the bailout of Washington Mutual during the Financial Crisis, over 500 small banks have gone under. The key here is the magnitude of the deposit base and the speed at which the bank run happened. This unfolded so quickly that markets worried about who could be next, and rampant speculation began to lead to further deposit outflows from small banks into larger banks that many perceive as safer. To help staunch the bleeding, the US Treasury and Federal Reserve both stepped in to provide liquidity and financial backing for those uninsured depositors. That seemed to help squash the panic in the short term, but the regional banking index is still down more than 30% for the year, and other large international banks, like Credit Suisse, got caught up in the financial storm and had to be propped up and eventually bailed out by the Swiss government and UBS. It would be foolish to assume that this fire has been completely put out. Investors should be wary to jump in on the banking sector as large unrealized losses from held-to-maturity (HTM) bond portfolios and shaky commercial real estate loans have yet to be drawn out.

On a contrasting note, one sector’s pain is another sector’s gain. And that is exactly what our Midwest team, the Nasdaq 100 Index experienced thus far in the first quarter. Composed primarily of tech heavyweights, the Nasdaq is up 20% YTD. While the banks and other value stocks were suffering, growth jumped back into favor. After a massive underperformance in 2022, tech giants Apple, Microsoft, Google, Meta (Facebook), etc. are off to a fast start. Their fortress-like balance sheets and economies of scale were seen as a safe haven to ride out the current financial storm. Historically, growth companies that promise higher potential have done poorly relative to value companies in a rising interest rate environment. Perhaps investors are reading between the tea leaves and assuming that rates won’t be as high as they are now for long. However, we’d be wary to take that bet with inflation still stubbornly high and other officials still adamant that they can fix the imbalance with tighter monetary policy.

Speaking of which, out of the East we have our perennial Final Four participant, the Federal Reserve (Fed), led by Chairman Powell. After hiking interest rates from the zero-bound in 2022 to 5% as of March, the Fed has attempted to stymie the economy to control inflation. To some degree it has worked; Inflation has gone from double digits annually to 6% as of February. However, this is still far from the Fed’s 2% inflation target. Given the historically low unemployment rate, their dual mandate of protecting the labor markets and promoting price stability favors the latter. So, it remains likely that they stay the course rather than cut rates again anytime soon.

One caveat to consider is the health of the banking sector. By raising the Fed Funds rate so significantly in a short amount of time, the Fed finally broke something in the financial plumbing system. In a nutshell, banks own a lot of US Treasuries on their balance sheets because the Fed said they were riskless and didn’t need to be marked to the market price since they are held to maturity. So, banks loaded up on them (both short and long-term) to make sure they had the appropriate capital levels to pass the annual stress tests. Remarkably, the stress tests created by regulators failed to factor in both credit risk and interest rate risk. So, while the safety of the Treasuries is not in question, the market value of said bonds has dropped significantly in the interim. Remember bonds losing 13% in 2022?

Enter a run on the bank at SVB, where they had loaded up on long-term Treasuries that had sunk in value and had to sell these “HTM” securities to meet outflows, and all of a sudden, they were insolvent. Thus, by further raising interest rates, they are expanding this inherent problem clogging the bank balance sheets. Banks are the lifeblood of the economy, and their lending facilitates growth. If banks pull back or tighten their lending standards due to the Fed’s hawkish monetary policy, then we will have a recession very soon.

Last but not least, we have US Treasury Bonds representing the South region. As we mentioned earlier, these government bonds have already played a big part in the failure of two banks this year, but they’ve also ended the TINA trade (There Is No Alternative to stocks). For what seems like ages, interest rates have been historically low, and your cash earned next to nothing. Thus, investors felt compelled to invest in stocks and other risk assets where at least there was the potential for higher returns. Enter the Fed and multiple interest rate increases, and now there is a viable alternative. As recently as a few weeks ago, US Treasury Bills reached a yield of 5.3%, and have settled back around 4.5-4.8%. Given the volatility in the stock market and many other macroeconomic variable facing investors, it is now a viable option to park some of your portfolio in a cash equivalent that returns significantly more than it did just last year. However, that yield is only good for a short time period, and then you’d need to re-invest when the bond matures.

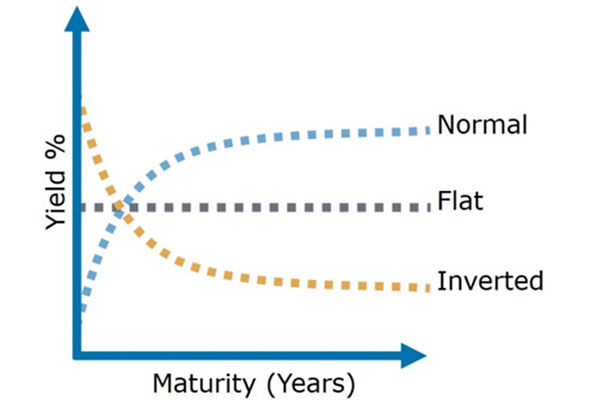

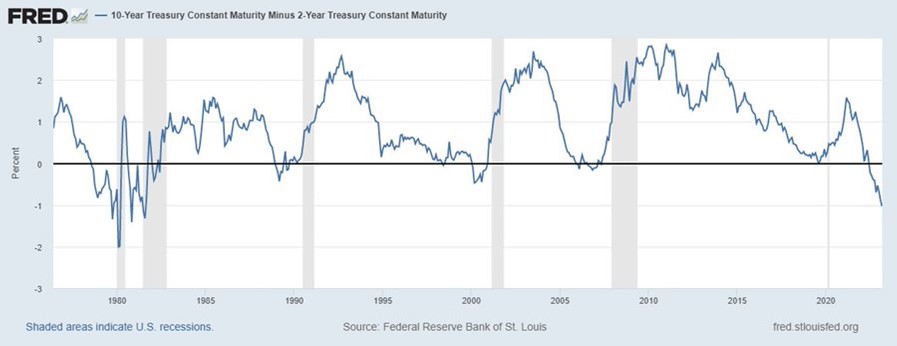

This brings us to the next interesting development. For the first time since 2020, the Treasury bond yield curve has inverted. What this means is that the longer-maturity bonds issued by the US Treasury yield less than the shorter-term bonds. This is not “normal”. In a typical economic environment, investors demand a premium for tying up their money for a longer term. What this portends is not usually good.

As you’ll note in the chart above, when the 10-year Treasury yields less than the 2-year it creates an inverted yield curve, and this directly corresponds with a soon-to-be recession. Given this trend, it certainly looks like we are due for a recession. Whether that is a shallow recession or prolonged period of economic malaise will depend on other factors, but it is safe to consider re-tooling your investment strategy with that in mind. The good news is that on average the stock market bottoms six months before a recession (defined as two straight quarters of negative GDP growth) is declared. So, we may already be there or close to it.

What may ultimately decide whether the economy can bounce back quickly or even avoid a recession altogether is the fiscal decisions made by Congress. Treasury bonds play a huge part in financing the economic growth in the US as well as influencing the expansion or contraction of the money supply. Ideally, to fight inflation, Congress would spend less and need less debt to finance these expenditures. However, that comes at the cost of economic growth.

There is also the pending decision on the debt ceiling, which is the legislative legal limit on how much the Government can borrow. This figure currently stands at a staggering $31.4 Trillion as established by congress in 2021 and would likely be reached sometime in Mid-Summer. Since 1960, Congress has raised the debt ceiling 78 times (49 times under Republican Presidents and 29 times under Democrat Presidents). As of now, it seems that a partisan collision course is likely, which even if resolved at the last minute, threatens to send shockwaves through the markets. The last time the debate stretched to the 11th hour in August 2010, the rating agencies lowered the credit rating on US debt from AAA to AA+, and the market got spooked and dropped 20%. Let’s hope that cooler heads prevail and that a compromise is settled long before the Treasury Department has to take extraordinary measures to pay government workers and social security recipients.

In the meantime, the current market environment demands vigilance. Instead of trying to dribble out the clock before halftime, a better alternative would be to make the appropriate adjustments now. Don’t let these Final Four investment forces drive your portfolio; instead, make sure your defensive cash and bond securities are sound, which should lead to plenty of opportunities later in the year to score points in the equity markets.