For the average American, around 70% of their net worth is tied to the value of their home. With this in mind, it is impossible to ignore the health of the housing market when assessing the state of the overall economy. Mortgage rates have tripled over the past three years, which has led to a housing market that is best described as being frozen. Pundits, and even the President, frequently opine on high mortgage rates and the negative effect they are having on the housing market and economy. So, are things really that bad in real estate?

Since the post-COVID era hysteria, residential sales volumes have plummeted over the past two years. Now, we are slowly starting to see a market dethawing as more homes are coming up for sale. Active listings across the US are up 31.5% year over year — a large number, but keep in mind we are coming off of what was historically low inventory figures. Also, inventories for new homes have tripled from their 2012 lows and are now approaching 2007 bubble highs. There is plenty of inventory on the market, and that certainly had not been the case for most of this decade.

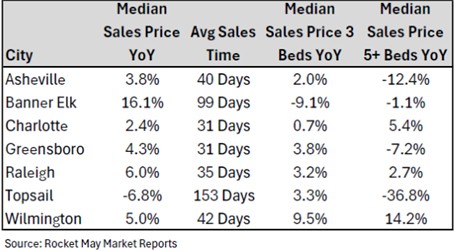

North Carolina has had one of the stronger housing markets in the country over the past few years, and it is currently fairly stable. As we review the major residential markets locally, more homes are coming onto the market and average times to sales have been increasing. Charlotte, Greensboro, and Raleigh are still considered seller’s markets, but cracks are starting to show in the median sales price of higher-end homes. If you are trying to sell a larger property over $600k, you may need to have some patience and muted expectations.

The data is less rosy for the vacation areas in North Carolina. Communities such as Banner Elk and Topsail have average sales times that are now over three months long. Many investors in these communities are having buyer’s remorse over purchases that were intended to be profitable short-term rentals. Bookings have decreased for many, and higher insurance, maintenance and tax costs have killed what little expected cash flow remained. This has many investors looking for the exits. However, sellers have yet to completely throw in the towel in these communities and seem to be stubborn on prices. While there aren’t many great deals showing yet, one may have some luck throwing out “low ball” offers.

If a real estate investor is looking for a real bargain, then commercial office space could be of interest. The current environment in office properties is nothing short of apocalyptic. A combination of the shift to work from home and continued economic deterioration in many inner city locations has caused a mass business exodus that has crushed the pricing in large scale office buildings across the country.

Buildings in many large cities are essentially being given away for free. This is especially prevalent in cities such as Baltimore, Chicago, and Detroit that have experienced decades of population loss leaving them with an excess of infrastructure. Without a large economic rebound, many of these buildings will eventually be bulldozed, so even a $0 price tag is likely still too expensive.

The real surprise in commercial office is that the bargains abound even in areas considered to be economically stable. Madison Park in Winson Salem recently went to auction with a starting bid of $4.2 million. The site consists of seven buildings and 483k square feet on 28 acres. In Greensboro, the old Oakwood Homes headquarters off I-40 is being auctioned with a starting bid of $1.3 million for 132k square feet. These prices come out to a mind boggling $10 per square feet which is likely 90% less than the cost of their construction 30+ years ago.

Commercial real estate isn’t for amateurs, but if you have the cash and a solution for filling up 100k square feet of unloved and unwanted office space, then you may be looking at a deal of a lifetime.