The so-called One Big Beautiful Bill Act (OBBBA) was signed into law on July 4, 2025. This almost 900 page behemoth contains hundreds of provisions that effect everything from taxes to the environment. In fact, one summary I read was a concise 80 pages! There are some far reaching aspects that we can’t fit into a two page newsletter, nor do we intend to evaluate the partisan political good, bad, or ugly within the text. With that in mind, we will do our best to focus on the key provisions in the bill as they pertain to your household finances.

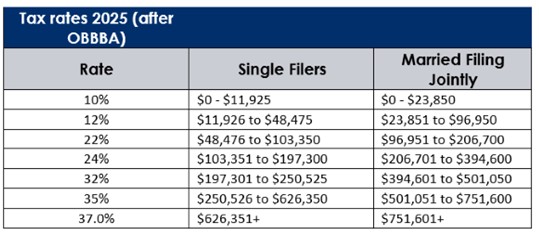

First, the basics. This reconciliation bill caps off the final step in the budgetary process. Because it was passed through Congress without a super majority, many of the provisions are temporary due to procedural budgetary rules. However, one of the biggest takeaways from the Bill is that many of the provision from the Tax Cuts and Jobs Act of 2017 (TCJA), which was signed into law during the first Trump term, were extended. For individuals, this includes maintaining the modified tax brackets put in place by the TCJA.

The bill includes many of Trump’s campaign promises related to tipped and overtime pay, deductibility of interest on car loans, and other benefits for seniors. Additionally, the Qualified Business Income (QBI) deduction for pass-through entities was made permanent as well as the increased standard deduction ($16K for individuals/ $32K joint—adjusted for inflation annually). Some past limitations, such as $750K indebtedness limit for mortgage interest and the repeal of miscellaneous itemized deductions were made permanent as well. Having some certainty now that these expiring provisions will be permanent should help individuals make more efficient decisions regarding their situation instead of wondering what will or will not be in place come January 1st. Let’s get more into the details of what did actually change.

The State and Local Tax (SALT) deduction was increased from $10K to $40K. This is a big change for those that live in states with high property and income tax bills. These taxpayers may get a significant increased itemized deduction on their federal return. This increased deduction applies to filers that have modified adjusted gross income below $500K and phases out above that amount. It applies only for tax years 2025-2029 and thereafter would revert to $10K absent future legislation.

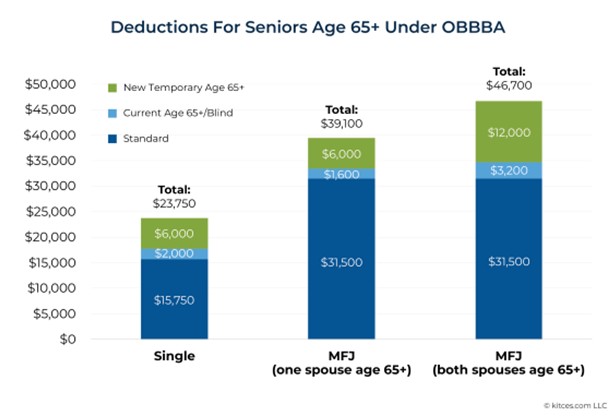

The new senior tax exemption applies to individuals age 65 or older and provides a $6K credit per qualified person for those with incomes under $75Ksingle or $150K joint. While this is not a direct elimination on the taxation of social security benefits, it is a comparable offset for the average tax paid on social security income. This new provision applies for 2025-2028 and adds on to both the current standard deduction and 65+/blind deduction that are currently available to taxpayers.

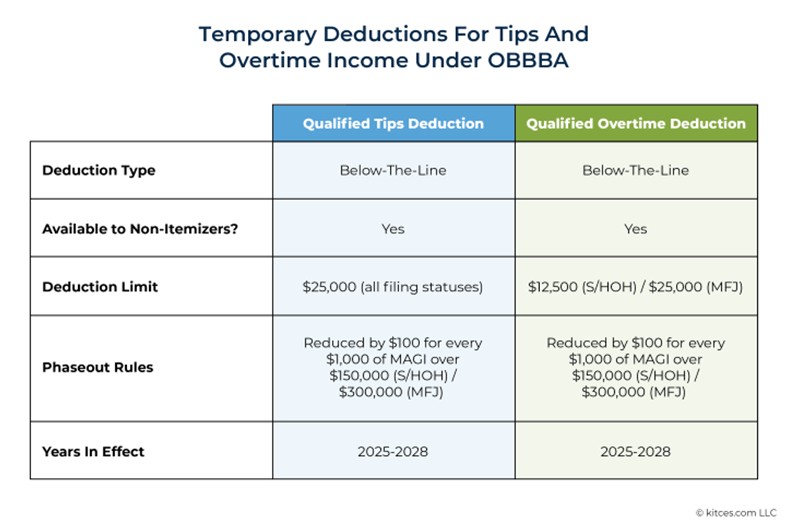

Other campaign promises of “No tax on tips” and “No tax on overtime” are also incorporated into OBBBA. Basically, you are still taxed on your wages both tips and salary, but can get a deduction for up to $25,000 of qualified tips. Qualifying income must meet certain criteria such as being earned in an occupation that “traditionally and customarily” receives tips and it must be “voluntary” and not mandated. This deduction also phases out at certain income thresholds and is only eligible to those in certain specific professions known as Specified Service Trades or Businesses (SSTB)s. So, don’t try and restructure your pay to be partially “tips” instead of regular wages if your job doesn’t fall into the approved classification (sorry lawyers, doctors, architects, etc.) These two provisions apply only to tax years 2025-2028. As to the overtime provisions, there is no requirement related to SSTBs. Everyone is eligible for the deduction, but it varies based on your filing status and is calculated based on the amount earned above your base wages, not the full amount earned during those overtime hours worked. The phaseouts are the same as the Tips provision.

The OBBBA also adds a new above-the-line deduction for auto loan interest. This deduction can be up to $10K, but it has a number of criteria that must be met, including that the final assembly of the vehicle take place in the USA. To find out if your new vehicle purchased between 2025-2028 qualifies, you can verify via the VIN number.

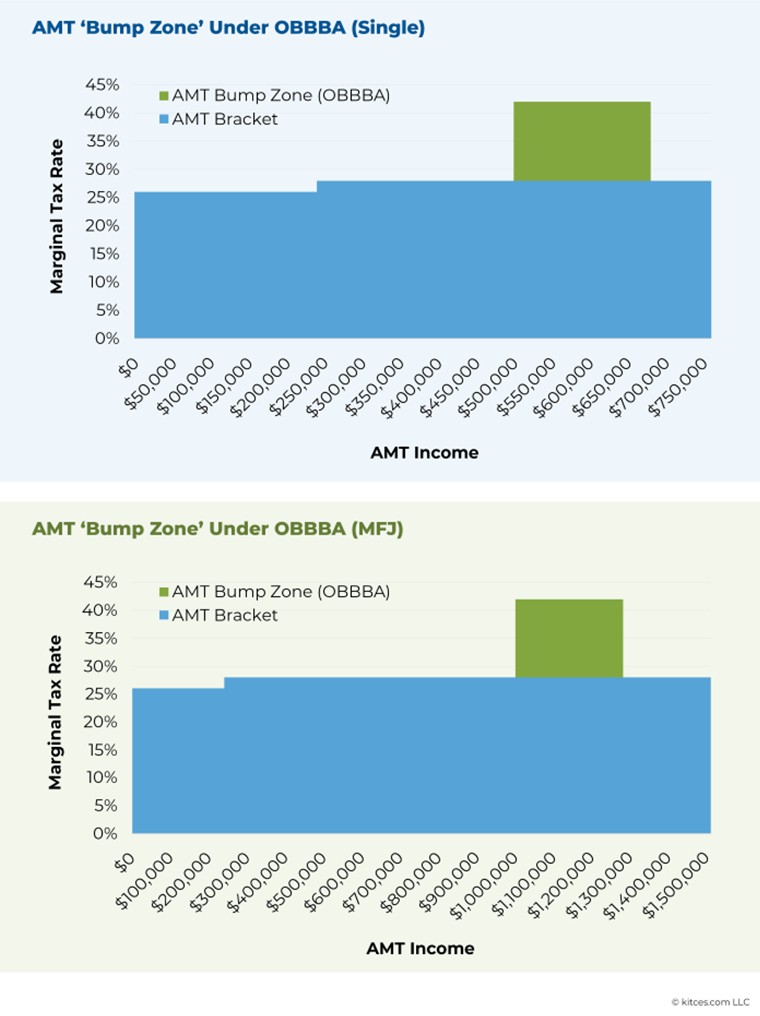

Some important tax saving provisions that were set to sunset but didn’t include the child tax credit, estate tax exemption, and the Alternative Minimum Tax (AMT) phaseout exemption levels. Under the TCJA the child tax credit of $2,000 per child was set to expire and revert to $1K, where it was prior to 2018. The OBBBA increased the deduction to $2,200 and indexes it for inflation annually. Similarly, the Estate tax exemption of $13.99M per person was set to expire and revert to a level approximately 50% lower. However, now the applicable exemption has been increased to $15M and will also be indexed for inflation moving forward. As to AMT, the TCJA greatly reduced the amount of tax filers subject to this tax by increasing exemption amounts and raising the phaseout thresholds. Currently, the phaseout thresholds are $626,350 for single filers and $1,252,700 for joint filers. As a result of these changes, only about 0.1% of households currently owe AMT. The OBBBA actually lowers the phaseout thresholds to $500K for individuals and $1M for joint returns. This could potentially bump more household into AMT. Finally, for those considering charitable contributions, the OBBBA installed new limitations. Starting in 2026, individuals can only deduct charitable contributions that exceed .5% of their adjusted gross income (AGI). This may mean it makes sense to fast forward some planned gifts in 2025 before this new change takes affect.

This is not an exhaustive list of all the changes and impacts associated with the OBBBA. You should consult with your tax advisor to better understand the nuances and how they will affect your personal situation. Hopefully, the result will be a big beautiful tax break for most of us.