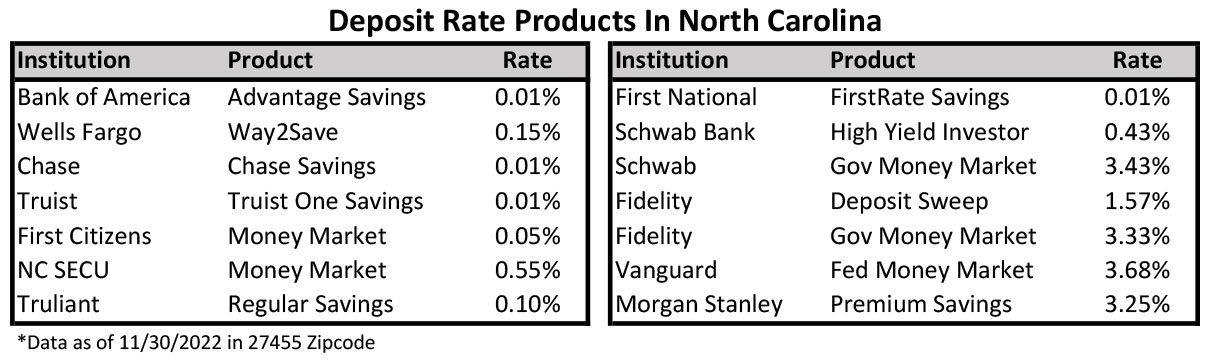

It has been a historic year for interest rate hikes. The Federal Reserve has increased their target rate by nearly 4% in just the last year, and the average 30-year mortgage now sits at a staggering 7%. However, you may have noticed that your bank account hasn’t gotten the memo on these rate changes. According to Bankrate, the national average interest rate for a savings deposit account is a paltry 0.19% as of a November 22 survey, and many large institutions are still paying 0.01% on a variety of savings products.

If you need one day liquidity on your cash, there are higher rates to be had, but you won’t find them at your bank. Based on our survey, most of the major brokerage firms now have money market funds with yields over 3%. These funds aren’t FDIC insured like a bank deposit, but Government Money Market funds typically have the bulk of their assets invested in short-term US Treasuries.

Banks seem to have universally rejected the idea of increasing deposit rates during this business cycle, and now one must wonder if they ever plan on paying competitive deposit rates ever again. Currently the Federal Reserve is paying banks 3.9% on reserve balances, so there is a lot of wiggle room for banks to increase deposit rates and still turn a hefty profit. The only reason to not increase rates at this point is if bankers are concerned about the large portfolio of 3% loans issued over the last few years that are still on the books. It is understandably a challenge to start paying out 3% on customer deposits if 80% or more of your book of loans were issued with cheap money. Regardless of the reason for anemic bank deposit rates, it is the job of the prudent investor to change ships if the one they are on isn’t moving. For the better part of the last decade one could be lazy with bank deposits because the interest rate was 0% regardless of where you banked, but those days are thankfully changing.