2025 has already been a wild ride so far. What can we expect for the rest of the year? Will the Trump Administration’s policies lead to a market victory, or will March’s tariff tantrum sink the ship? Are international stocks finally going to reverse a decade long trend of underperformance and trounce their domestic counterparts? Will gold’s one shining moment repeat in 2025? These are just a few of the questions investors are asking themselves after a volatile first quarter. How will the answers to these topics play out in this year’s investors’ Final Four? Let’s dive in and see which themes will reign supreme.

Out of the Midwest, we have the “Magnificent 7” (Mag 7) stocks: Apple, Nvidia, Google, Meta, Microsoft, Amazon, and Tesla. These behemoths of market cap have grown to represent more than one third of all the combined market cap of the S&P 500 index. Their growth has propelled U.S stock markets exponentially higher over the last two years, but things have soured so far in 2025. With an average drawdown of more than 20% from their peak, $3 trillion of wealth has disappeared from investors’ pockets. Whether it is simply reverting to the mean, or fears that the Artificial Intelligence (AI) hype is not all it is cracked up to be, these 7 stocks have bogged down the whole market due to their sheer size. Maybe it’s time for investors to hit the transfer portal and pursue an equal-weighted strategy rather than the market-weighted index.

On the flip side, the Mag 7’s loss has been international stocks’ gain. The MSCI EAFE (Europe, Australasia, and the Far East) Index, which tracks large and mid-cap stocks in the rest of the developed world, is up close to 10% in 2025. While this short-term out-performance is notable, there’s a long way to go to even the score. Long-term, US stocks have dominated the head-to-head record with an average annualized return of 12% over the past decade versus 5% returns for the rest of the world. If this is the start of a new trend, then it is still very early on, relatively speaking. However, it could still be just a reversion to the mean adjustment. The economic policies of higher regulation and taxation that have largely led to international underperformance haven’t changed. From this referee’s eyes, it looks like purely a valuation shift. International stocks are much cheaper on a price/earnings ratio and investors are seeking safety from what they believe is a U.S. market that was priced for perfection.

Gaining the top seed in the South is once again the shiny yellow metal, gold. After a 26% gain in 2024, gold has shown its luster again with a 19% jump in the first quarter. All those cryptocurrency aficionados must be asking themselves if gold is the new bitcoin? Kidding aside, it’s remarkable that since the 2024 election and the promise of a more crypto- friendly regime, Bitcoin is down double digits while gold continues to climb. If we review this play on the monitor, what you will see is that it’s not the fear of inflation or volatility driving up gold prices anymore, but rather a 4% drop in the US dollar versus a basket of other currencies as well as some basic supply and demand dynamics.

In an effort to diversify away from US dollars, many countries around the world, especially China, have been big buyers of gold bullion. Additionally, the fear of tariffs on delivery of gold across the border has front-loaded a lot of demand and caused deliveries to spike in the US. Gold’s big run could struggle from here absent other material factors. Geopolitical instability and further dollar weakening will probably keep a floor under gold, but don’t expect the top seed to cut down the nets again this year.

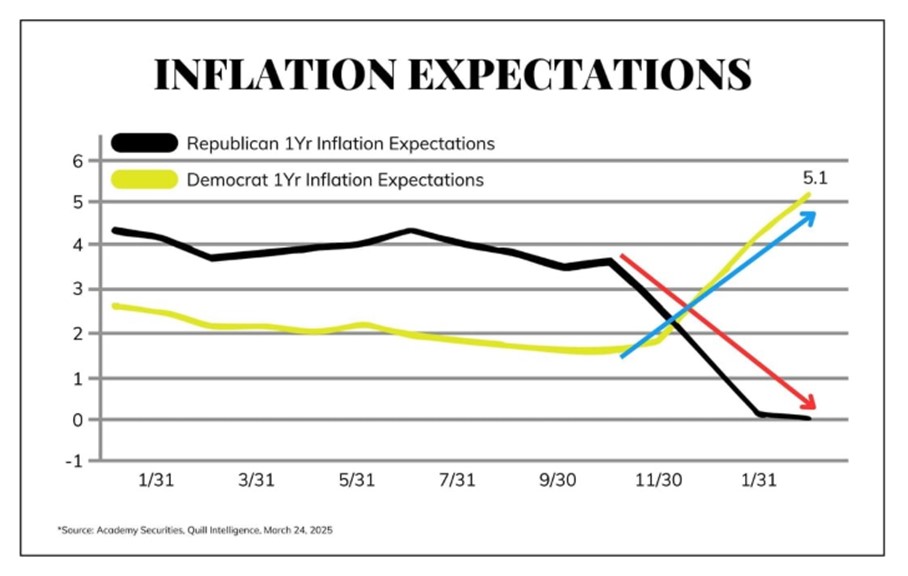

Hailing from the East region, the Trump Administration’s 2nd go round has been fast and furious. The team’s speed has taken its opponents by surprise, and the market can’t seem to make up its mind as to whether it’s an effective strategy or not. After an initial post-election bump, US stocks have hit a wall and dropped about 13% from peak to trough. That being said, the price action has felt a lot worse than the end result. As of March 31st, the S&P 500 is actually only down 4%. So, why does it feel so much worse? Well, I think that depends on who you talk to. Not surprisingly, the partisan nature of politics can bleed over into market sentiment. The graphic below expresses that relationship pretty clearly.

Republicans believe that inflation will go to 0% and Democrats think the same data will lead to 5% inflation. That divergence is pretty crazy, so who is right? Like most political answers, the truth is likely somewhere in the middle, which happens to be 2.5% — almost exactly where we sit on the most recent consumer price index (CPI) release. The political noise is distracting investors from the most impactful policies and economic factors that are likely to drive stock market performance in 2025 and beyond. Let’s look at a couple of those major driving forces in Trump 2.0.

First and foremost, tariffs can’t be ignored. I think it’s fair to say that markets have a strong aversion to tariffs. Whether they are implemented or just a negotiating tactic, stocks have reacted negatively to any mention of tariffs. During his first term, Trump’s first salvo at tariffs started a trade war with China and the market sold off 4.38%. However, the following year, US stocks gained 31.49%. A significant majority of those tariffs stayed in place throughout his 1st term and through the entire Biden administration. Needless to say, the U.S stock market did have its hiccups over those years, but the overall performance was above-average. And yet, investors continue to be spooked by the fear of the rising costs of goods associated with tariffs. This time is different, and Trump 2.0 seems to be upping the magnitude of the rhetoric and the nations (friend and foe) that are targeted. However, these potential economic drags need to be looked at as part of the big economic picture. If Trump’s signature tax cuts from his first term are extended instead of expiring by year’s end, then the positive wealth effect might be more significant than the rising prices on certain goods. Or, what if the Department of Government Efficiency (DOGE) task force reduces government spending significantly enough that its deflationary impact allows for a return to lower interest rates? As you can see, it’s a complex web of trade-offs that on the whole could be positive for stocks in the long-run. It won’t be a straight line, and it may in fact get uglier at some point, but staying invested and diversified continues to be the most likely strategy for winning the big game.

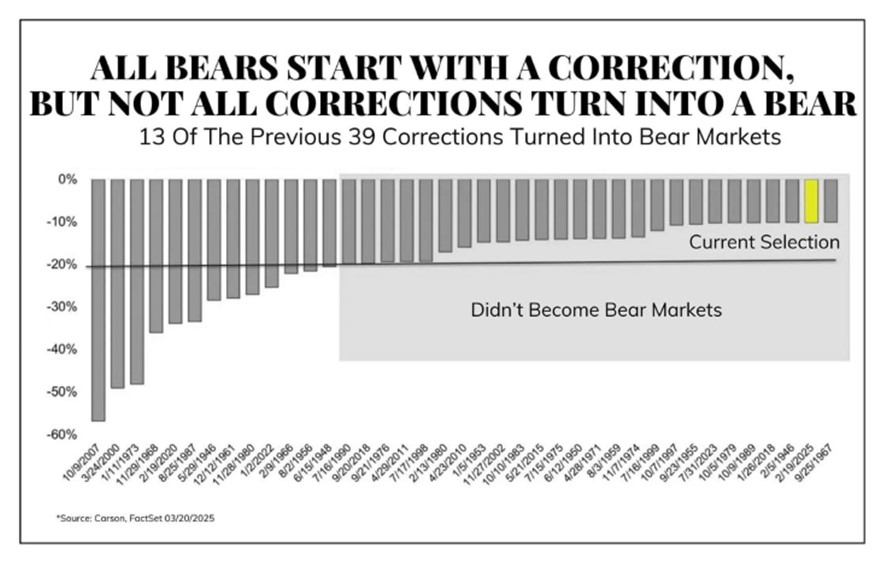

The average annual drawdown from peak to trough in the S&P 500 since 1900 is 13.8%. We have seen that already in 2025, but it isn’t unusual, and doesn’t necessarily portend a bigger drop or the onset of a bear market (20%+ decline). We will see many bear markets over the next few decades (every 6 years on average), and investors must continue to navigate through them. Keeping your head and executing the playbook when all around you are panicking is truly the only way to ensure you cut down the nets.

I think this is the first time in a decade I haven’t had the Federal Reserve as one of the bracket participants. Take that as you will, but perhaps it’s a positive development that we aren’t as dependent on the direction of interest rates as many past scenarios. For what it’s worth, we think the whipsaw of policies and the uncertainty it creates will keep the Fed guessing on what is the true economic data and what is transitory in nature, thus largely keeping them on the sideline for 2025.