Inflation is the topic du jour these days—and for good reason. With the price of just about everything seemingly up double digits in the last year, it’s hard to escape the daily frustration as goods and services take a bigger bite out of our pocketbooks. With stocks and bonds both significantly underwater for the first half of the year, how do you counteract the deflation in your portfolio while at the same time taming rampant inflation? Unfortunately, there seems to be no panacea in the public markets, but there is one lesser known option available privately through the US Treasury.

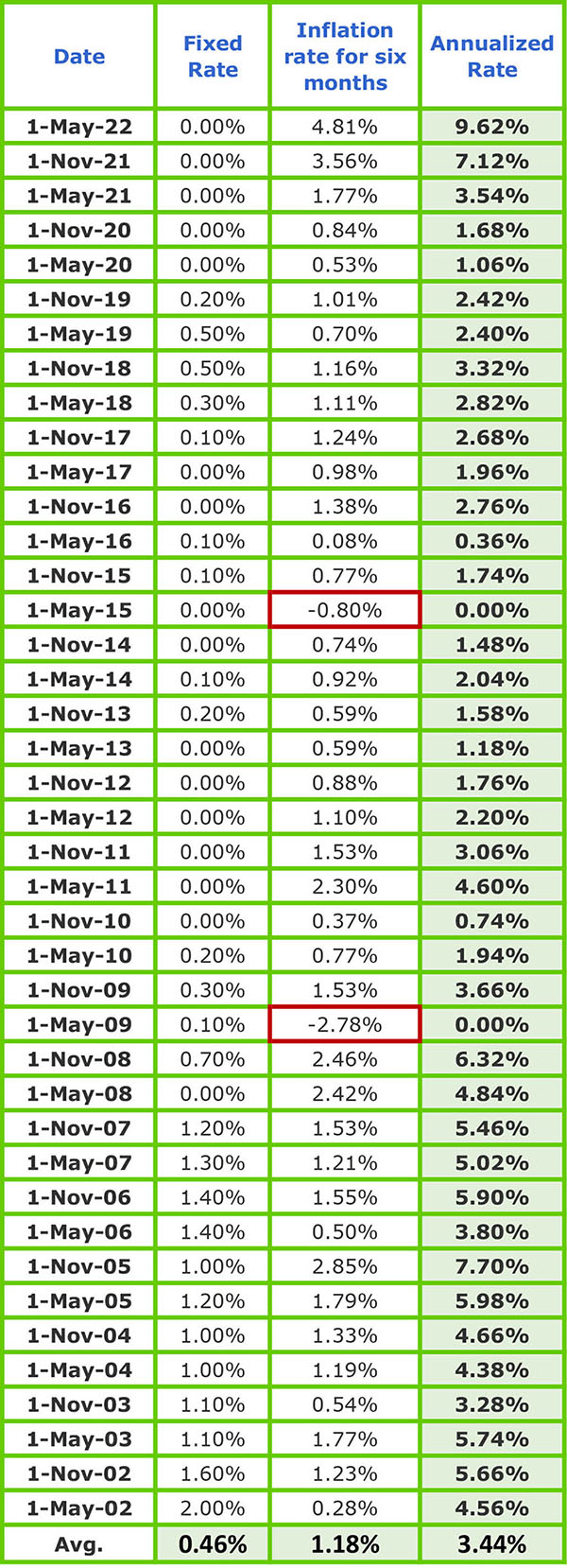

Series I Savings Bonds issued by the government are long-term bonds that have both a fixed rate and a variable interest rate. The base fixed rate is determined at the purchase date for the life of the bond and is typically very low. The variable rate mirrors the most recent reading on the consumer price index (CPI). By combining the two rates with a floor of 0%, you get the total interest rate. For the last decade, this has meant some pretty paltry yields, but starting in late 2021, the variable portion of the Series I Bonds has moved up materially. As of this May, newly issued Series I Bonds yield an annualized 9.62% for at least the next six months until they reset according to their semi-annual adjustment in November. Should inflation continue to run rampant for a prolonged period of time, Series I bonds should continue to provide at least purchasing power parity for dollars invested in them. As a bonus, similar to Series EE savings bonds (fixed rate only) that many of you may have seen or used in the past to save for a child’s education, Series I Bonds can be used for that same limited purpose and receive the interest tax free.

However, there are several caveats that make these less desirable than the look on the surface. First, these are not available like normal securities through the public markets and your brokerage account. You must set up an account at www.treasurydirect.gov to purchase Series I Bonds which gives a DMV like customer experience. Second, you can only purchase up to $10,000 per person per year. Third, these are technically 30 year maturity bonds, and you don’t receive any interest until you sell them. You can sell them any time after the first 12 months, but if you do so before the 5 year mark, you forfeit the last 3 months of interest. Finally, even though inflation is historically high right now, it potentially won’t last forever. In fact, if the economy goes into a recession, it wouldn’t be unusual to see deflation, such as in 2009 following the financial crisis.

Over the last 20 years, the average annualized interest rate for Series I Bonds would have been 3.44%, which falls short of both the long-term expected returns of the aggregate bond index (3-5%) and the stock market (8-10%).

While Series I Bonds might be a nice addition to your investment team, don’t expect them to be a long-term solution to the pains of higher prices.