As many of you probably know, the House and Senate approved the final version of the tax reform legislation in the last week of 2017, and President Trump signed into law the Tax Cut & Jobs Act ("The Act"). This new legislation will have a profound impact on many aspects of the tax system in the United States and is likely to impact both individuals and businesses significantly over the next decade. Due to procedural nuances of how the bill was passed as part of a budget resolution (known as the Byrd Rule), the new tax provisions expire in 10 years concurrent with the budget window.

Although this new law was touted as a major tax cut, we think it is better labeled as a tax reform. The Act eliminates or modifies a number of well-known business and individual deductions, credits, and incentives. Depending on where you fall in the various brackets and whether you itemize will make a big difference on whether you can expect a beneficial move in your future tax bill.

Corporations appear to be the big winners. With a rate drop from 35% to 21%, Many C corporations will see a decrease in their impending tax liabilities. To put small business owners on a similar playing field, The Act provides a deduction for 20% of qualified business income. However, the rules for this deduction are complicated and many will receive a smaller than expected benefit.

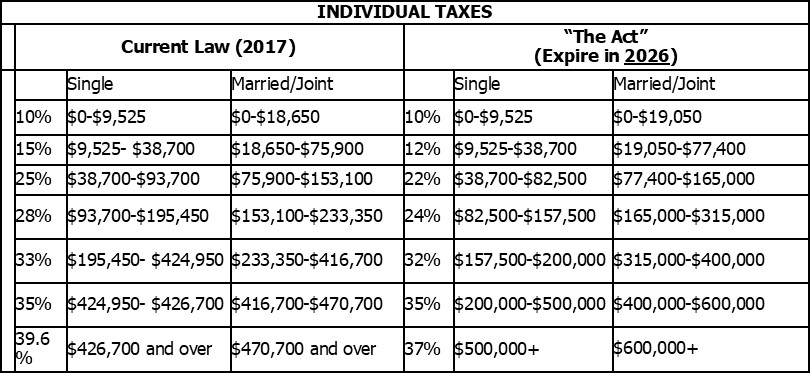

On the individual side, the biggest changes are in the modified marginal tax brackets and the increased standard deduction. I've pasted a comparison of the 2017 and 2018 table above, and as you can probably tell, the new law kept the 7 different brackets, but modified the rates and thresholds. On top of the bracket changes, the standard deduction for both single and married filers has been doubled (12K for single and 24K for married filers). Given that nearly 70% of tax filers claim the standard deduction, this will undoubtedly help the masses, but may not be to your benefit if you have a lot of mortgage interest, charitable contributions, etc. that would put you above the threshold.

Some other notable provisions in the tax bill include:

- 529 contributions can now be used for K-12 education as well as post-graduate expenses)

- The estate tax exemption is doubled to 11.2M per person (indexed for inflation).

- The Obamacare coverage penalty provision is eliminated as of 2019.

- Mortgage interest deduction is decreased to the first 750K of indebtedness versus 1MM.

- State, local, and property taxes are only deductible on your Federal tax return to the extent of $10K

- The child tax credit has been increased to $2K

- Qualified dividend and long-term capital gains rates remain unchanged.