For the past year, there has been a substantial amount of debate around student loan forgiveness. Politicians, mainly on the left, have advocated for the forgiveness of between $10,000 to $50,000 of debt. This leaves those with student loans in the precarious situation of deciding whether to pay off these existing loans, or delay payments in hopes of a windfall from Uncle Sam.

Some action has been taken already by the Biden administration in this matter. In August, loan discharges of $5.8 billion were given via executive order to approximately 323,000 borrowers who have a total and permanent disability. This was a significant forgiveness. However, it is safe to assume that the bulk of these loans were uncollectable, so the government is essentially just recognizing that fact, and cleaning up the books.

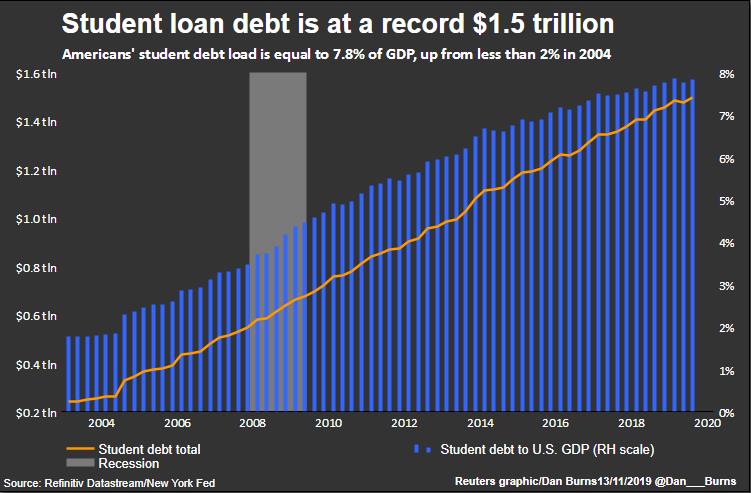

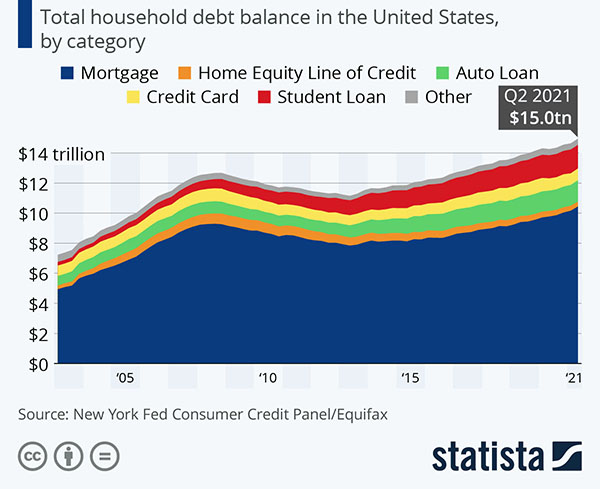

Total student debt has nearly tripled over the last decade and climbed to over $1.5 trillion in the United States. In comparison, the other categories of debt have grown but stayed relatively stable over the same span. It is interesting that after the 2008 financial crisis Americans were quite responsible with debt, relatively speaking, with the exception of those in college.

If you have student debt, should you pay off those loans or keep waiting for a bailout? When trying to read the political tea leaves, one must decide if the current majority party has both the numbers and the political capital to pass a significant bailout either legislatively or via executive order (scholars debate whether the President has legal authority for wide-spread forgiveness). With slim majorities in the House and Senate, the democrats currently have the numbers until at least the 2022 mid-term elections. Given that Congress and the Biden administration have prioritized spending for Covid bailouts and infrastructure this year, it is not far-fetched that they may try to tackle broader student debt relief as well.

A package that would pay off $10k per borrower would have a price tag of around $400 billion, while the $50k forgiveness target would cost an estimated full $1 trillion. Personally, I don’t see the Democrats having the political capital to execute the $50k per person forgiveness. However, the possibility of a smaller forgiveness coming through seems plausible. For those who are looking to accelerate student loan payoffs, we’re advising them to put the cash on the sidelines for the next few months and patiently wait.

Mid-term election cycles historically have caused the ruling party to lose seats in Congress. Should this occur, we'd be looking at a Republican controlled legislature that would be less likely to broker a compromise with the White House. If we don’t see loan forgiveness prioritized in the next six months, the chances of it coming to fruition drop dramatically. Planning for a small windfall may be prudent in this matter, but for those with larger student loan debt, we implore you to attack those balances and not idly wait for politicians to come to your aid. The government has been more than happy to put provisions in place that enables borrowers to amass huge student loan balances, so expecting that same government to be the one to save you from it is most likely a fool’s errand.