Goldilocks was an expert on a wide variety of subjects. Whether it was mattresses, porridge temperature, or 19th century furniture construction techniques, she was never afraid to let her opinions be known.

Despite her impressive array of knowledge, it is safe to bet that Goldilocks knew very little about bears. After all, she spent the majority of an entire day inside a bear den with little to any sign of her impending doom.

The modern day investor is very similar to Goldilocks in his/her lack of knowledge in regards to bear markets. Investors were welcomed into the new millennium by not just one but two roaring bear markets with 50% losses from peak to trough. After experiencing these two pullbacks in my professional career I have to admit that I'm absolutely frightened of bears as well!

The markets closed out the quarter down around 10% from recent January highs. Given this correction and the fact that I'm sure many of you share my Arkoudaphobia (fear of bears), I thought it would be a good time to review past bear markets from a historical perspective.

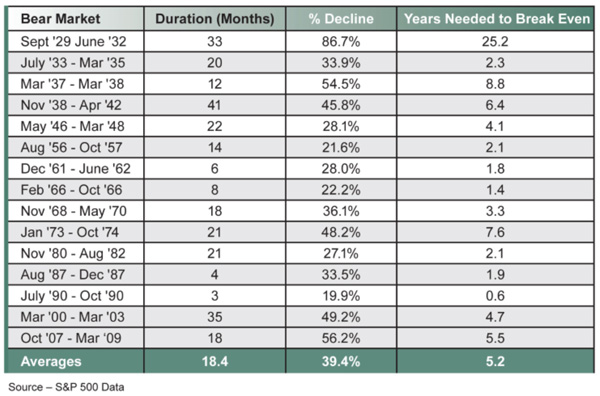

Over the past 90 years there have been 15 separate periods of bear markets, which are defined as a 20% or greater correction in the stock market. The average bear market decline has been nearly 40% and recovery time averages over 5 years.

You should be no stranger to these numbers considering the last two bear markets were the worst since the Great Depression. However, what is lost on many investors are the memories of "baby' bear markets of past. For example, the decade of the 1980's returned a stellar average market return of 14% annually. It is easy to forget that we endured 2 separate bear markets over that decade.

Have we entered a new bear market after nine years of market expansion? Unfortunately, it is impossible to say with any certainty. It is not unprecedented to experience bear markets during long periods of economic growth. However, these contractions are more shallow in nature and more in the magnitude of around 25%. If this recent 10% correction turns into a bear market it may be the best buying opportunity we've seen in quite some time.